Trump Tax Cut 2019 Edition.mp4

6

About :

So the twittersphere was abuzz with anger over Trump's latest floater.

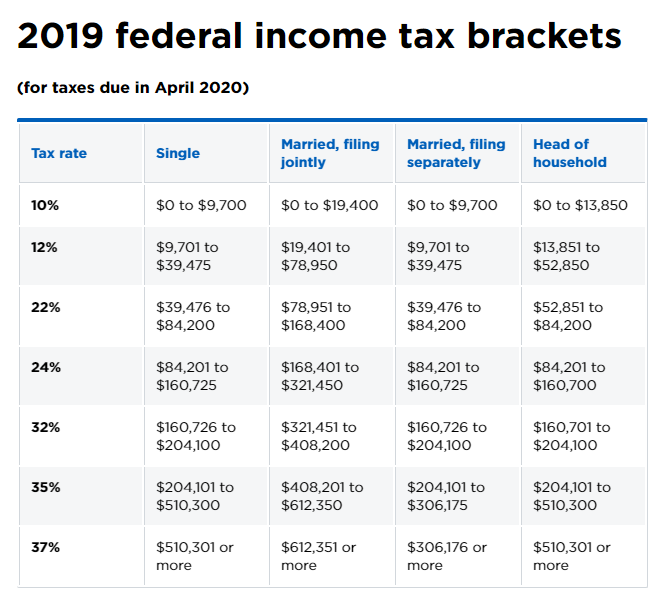

The headline is a "Middle Class" tax cut to 15%. We have to assume that is talking about the 22% bracket.

But a lot of people don't understand how tax brackets actually work, so in the video I walk through three examples: a single person, a married couple, and a married couple with one child to see how much they would have to earn to be affected by this "middle class" tax break.

The answers might surprise you.

Resources:

https://www.nerdwallet.com/blog/taxes/federal-income-tax-brackets/

https://en.wikipedia.org/wiki/Household_income_in_the_United_States#Distribution_of_household_income

https://www.cbo.gov/topics/income-distribution

https://www.zerohedge.com/markets/tax-cut-20-back-trump-exploring-cutting-rate-middle-class-15

Tags :

Their limit for today is $0!

Comments:

Reply:

To comment on this video please connect a HIVE account to your profile: Connect HIVE Account