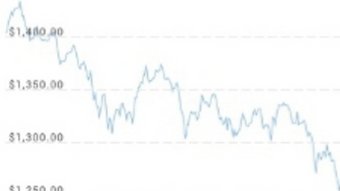

Effects of higher interest rate by loan apps

25

About :

High-interest rates on loans can have several effects. One of the most significant effects is that it makes borrowing more expensive. When interest rates are high, it becomes costlier to borrow money from banks or other financial institutions. This, in turn, can discourage people from borrowing, reducing the overall demand for loans.

Higher interest rates can also lead to higher monthly payments, which can put a strain on borrowers' budgets. This can result in a higher default rate as borrowers struggle to make their payments, leading to an increase in loan delinquencies.

Additionally, high interest rates can affect the economy as a whole. When borrowing becomes more expensive, businesses may reduce their investment and expansion plans. This can slow down economic growth, resulting in a possible decrease in job opportunities.

Conversely, high-interest rates can benefit savers as they can earn more on their savings and investments. However, these positive effects may be outweighed by the negative effects on borrowers, which can ultimately have a broader impact on the economy.

Tags :

Their limit for today is $0!

Comments:

Reply:

To comment on this video please connect a HIVE account to your profile: Connect HIVE Account