Why You Should Be Accumulating, Not Panic-Selling!

31

About :

Hey guys,

In this video I want to go over why the cryptocurrency market is crashing, and cover the reasons why this will only be a temporary correction in the overall long-term bull market we are currently in.

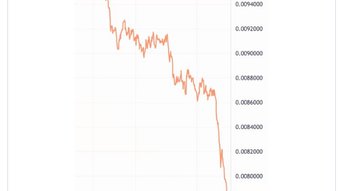

So why is the market crashing?

The Federal Reserve has raised interest rates by only 0.5% and the stock market can't seem to handle it. Over the past decade, investors have gotten so hooked on cheap 0% credit that they cannot even take a 2 basis rate hike. Similarly, back in 2018, the stock market crashed when the Fed raised rates to 2.5%. They had to backtrack and call off further rate hikes to save the markets from imploding.

However, this time around, with the official inflation rate at 8.5% (in reality it is much higher) the Fed has no good excuse to lower interest rates back to zero. They have to keep raising them, ever so slightly, to appear as though they are fighting the onslaught of skyrocketing prices. These higher interest rates means corporations have less money to spend on expanding their operations (or simply to buy their own stock), resulting in a selloff in the market.

So why does this affect the crypto markets too?

Most investors still consider cryptocurrencies to be risk-on assets like tech stocks, so they are selling them off, along with their NASDAQ portfolio. What they still do not realize is that cryptocurrencies are not stocks, but rather decentralized, censorship-resistance, global currencies, which continue to be adopted by nation states like El Salvador and Central African Republic, and major corporations like Fidelity and Gucci.

People are selling their stocks, bonds and crypto for US dollars because they see the USD as a safe haven to protect their wealth from these volatile markets. They aren't taking into consideration that greater than 40% of all US dollars in existence were created in the past two years. Thanks to this insane money printing, fiat currencies are headed towards hyperinflation. Trying to quell this raging inflation with a 0.5% interest rate hike is like trying to put out of raging apartment fire with a water pistol.

The question is, where will investors put their capital when they realize that we are in a hyperinflationary environment? Of course some of their wealth will go into commodities, such as food, oil and gold. But a significant amount will also go into cryptocurrencies, the only form of non-confiscatable money in existence that is experiencing rapid development and innovation.

Bottom line here is that you should not be freaking out and panic-selling with the crowd at this time. Several solid crypto projects are down 60-80% in the past few months and you should view this as an opportunity to scoop up these coins at bargain prices.

If you don't have cash on hand to invest, then you may want to consider diversifying your Bitcoin and Ethereum holdings into these alternative projects. The Bitcoin and Ethereum market dominance will continue to decline as more innovative and efficient blockchains capture a greater share of the market.

Godspeed to you during these tumultuous times.

Sources:

Tags :

Their limit for today is $0!

Comments:

Reply:

To comment on this video please connect a HIVE account to your profile: Connect HIVE Account