Why This Crypto Bull Run Is Going To Be Different From The Previous Ones

25

About :

Being a successful investor involves making educated guesses about the future, and that includes being able to predict the overall ups and downs in the market. Bitcoin, and crypto in general, has gone through several bull and bear cycles since its inception back in 2009:

- 2011: The price of Bitcoin skyrocketed to $32 and finally crashed to $2.

- 2014: Bitcoin hit a peak of $1200 and eventually plummeted to $200.

- 2017: Bitcoin went from a high of $20000 to a low of $3000.

And here we are, four years later in the fall of 2021, preparing for the next bull cycle. While many expect this pattern to continue, we need to examine what's different this time, and consider how the failing traditional financial system will impact crypto prices.

Money Printer Go Brrrrrr

The US dollar has been off the gold standard for over 50 years now, meaning that it is been backed by nothing but the government's promise to pay an increasingly insurmountable amount of debt, and our collective belief that it holds value.

In response to the financial crisis of '08, quantitative easing and negative interest rates were enacted, resulting in a massive amount of money creation between 2008 and 2019.

The money printing has gone into absolute hyperdrive since the covid lockdowns. Depending on which source you go by, anywhere from 20% to 40% of all US dollars in existence were created in the past 18 months.

The Consequences

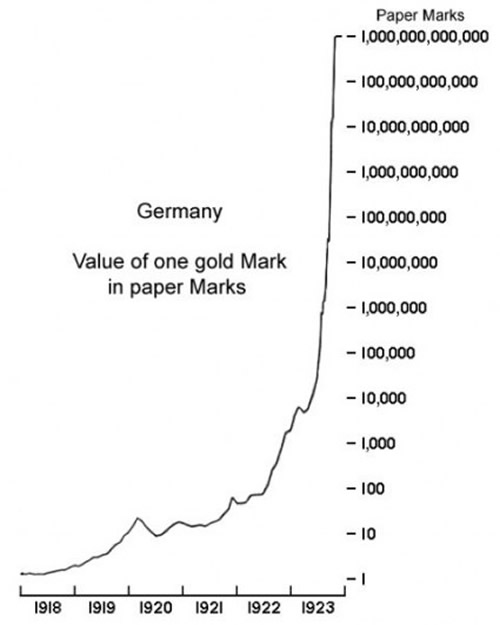

Even major banks like Bank of America have warned about the impending "transitory" hyperinflation coming our way. It would seem we've reached the final stage, where prices go up "gradually, and then all at once", similar to what happened to the Mark during Wymar Germany back in the 1920s.

Investors need to consider these facts as we head into the next crypto bull cycle. I imagine many new investors will see the price of their crypto skyrocket in the coming months and be tempted to sell it, without considering the possibility of their dollar "profits" being rapidly inflated away.

In previous bull cycles, hyperinflation wasn't an issue. This time around, far fewer investors will be selling their crypto for fiat. That's not to say there won't be sharp corrections throughout this bull cycle, but from my perspective the chance of an extended 2-3 year long bear market is very low.

Accelerated Adoption of Crypto

We must also consider the sheer number of people who are entering into the crypto space right now. Individuals who have been laid off due to the lockdowns and restrictions, or because they refused to take an experimental medication, have found salvation in decentralized finance.

There are kids in the Philippines earning more than minimum wage by playing games like Axie Infinity, Alien Worlds, and Splinterlands. More of these play-to-earn games are being rapidly developed and will continue to draw in more players from across the world.

As well, we have seen many talented individuals leave the traditional financial sector to join crypto startups. It's obvious that more and more people are starting to see the benefits of having complete control over their finances, instead of relying on a central bank, which monitors and controls all of their spending.

Where Do We Go From Here?

It's no secret that the central banks have been working on their CBDCs (central bank digital currencies) for years; and they will probably be rolled out sooner than we think. Earlier this year, Biden’s banking nominee called to eliminate all private bank accounts.

CBDCs give governments complete control of an individual's finances and dictate where and when one's money can be spent. Decentralized cryptocurrencies, on the other hand, transfer all power (and responsibility) to the individual.

Many people will prefer to have the government solve the problems, and will forfeit their rights and possibly even their own personal property to have the issues solved for them. Others will opt to maintain the ideals of personal liberty and property rights.

These next few years are going to be interesting, to say the least, as each individual will have to make a choice between government CBDCs or decentralized finance.

In Closing

Observing the price and adoption trends, humanity's transition to decentralized finance seems inevitable at this point. Eventually a critical mass of crypto adopters will have been reached, and then everybody else will be forced to follow.

Does this mean everyone HODLING their crypto is going to be rich? Well no, not in the traditional sense. The world is going to go through some major changes, and our traditional ideas of individual and property rights are going to be challenged. Being "rich" in the new world will come with a lot more responsibility compared to a lucky lottery winner in the old world.

Feedback

What's your opinion? Do you think this bull cycle is similar to previous ones and will be followed by an extended bear market, or will it run until fiat currency has been eaten up entirely?

Follow Me

HIVE -> @brennanhm

Twitter -> @brennanhm

Publish0x -> https://www.publish0x.com/@brennan

Odysee -> https://odysee.com/@brennan:b

Sources:

https://acting-man.com/blog/media/2016/02/

https://www.marketoracle.co.uk/images/2013/Sep/

https://techstartups.com/2021/05/22/40-us-dollars-existence-printed-last-12-months-america-repeating-mistake-1921-weimar-germany/

Tags :

Their limit for today is $0!

Comments:

Reply:

To comment on this video please connect a HIVE account to your profile: Connect HIVE Account