▶️ Bitcoin, Bitcoin Mining, & More Bitcoin - Amateur Investing #12 | EP#420

6

About :

Time for another update on my investment portfolio and my passive income journey. We’ll be covering my recent cryptocurrency & stock purchases, stock dividends, and crypto earned from staking. This is amateur investing at its finest!

Disclaimer: This is not financial advice and is purely for entertainment purposes. All my stock information is 100% accurate, but my crypto data may or may not be simulated

Timestamps:

00:00 Intro

01:54 Stock Dividends

02:56 Crypto Income

05:41 RealT

06:30 Crypto Portfolio

07:42 Stock Portfolio

09:43 Stock Trades

16:09 Crypto Trades

17:22 Total Portfolio Breakdown

22:33 Final Thoughts & Outro

I share everything so you can follow everything I’m doing with 100% transparency. The point of doing all this is to show you that it’s possible and provide some sort of framework that can be followed. This isn’t financial advice, and you shouldn’t exactly replicate my investing. What you should do is figure out what works best for you and stick to the basics of dollar-cost averaging, investing in good assets, avoid liabilities, compounding interest, be frugal, buy low, and sell high.

I cover my rules for investing here: https://lbry.tv/@ScottCBusiness:4/Investing:d

Here is the breakdown for my investing and budgeting templates: https://odysee.com/@ScottCBusiness:4/If-You-Want-To-Save-Money:7

Investing Spreadsheet Template Link: https://ufile.io/71mgq19h

Income Tracking Spreadsheet Template Link: https://ufile.io/frde28j9

Budgeting Spreadsheet Template Link: https://ufile.io/5bc6sxor

I cover the recent stock buys I went through, share my portfolio breakdown updates, and share my thoughts on the current market. I’ve done a lot of restructuring and made a few risky bets on Bitcoin mining stocks in February. I am currently making about $110.05 a month from passive income. This is a bit lower than before simply because I have sold off most of my passive crypto and I’m powering down on Hive as well as I sold all of my RealT tokenized real estate tokens. The reason was that I want to go all-in on Bitcoin and Ethereum for the bull run over the next 6 months.

My portfolio is roughly rounded to about 84% crypto, 15 % stock, 1% precious metals, and less than 1% in cash reserves. I’ve been dollar-cost averaging into mainly bitcoin, Ethereum, though in February I did do a lot of stock rebalancing. This is perfectly aligned with my goal of earning more money and saving 65% of my income. I am currently aligned with my goal having saved 66% of all my income this year and investing it.

My total annual projected income from passive sources is $1,320.09. $1,162.54 of those yearly profits are coming from stock dividends, about $141.04 are coming from cryptocurrency staking, I already earned $16.51 from my RealT crypto tokenized real estate before I sold it, and $0.45 from music royalties. I cannot set any projected amount for my royalties so I just update it as they come in. In my last update, my total portfolio value was $151,031 CAD. My current portfolio value with all my investments is $231,109.54 CAD. This is up to $80,078.54 from last month’s total value. The funny thing is that even with all the drops and everything that happened, on the larger scale when you look at it month to month, I’m still way up. Always stick to the long-term mindset when investing in Bitcoin. Do consider that I do have about $12,500 in debts and taxes to pay to be completely transparent about my net worth. With everything included it’s more like $218,609.54, but my total portfolio value is 231K as mentioned above.

I invested $4,300 last month. I earned $48.07 CAD from stock dividends, $0 CAD from crypto real estate, and $11.62 CAD from my last month of staking Hive, and 0.56 from MTR staking on Den.Social for the last few days of February. I will be earning a lot more on Den.Social in place of Hive because it got a higher APR and it’s fully liquid. In total, I have earned about $288.76 CAD from crypto and over $559.12 CAD from stock dividends.

My recent growth stock trades were: Selling off my few gold stocks and AMD, and investing that money along with about $5,000 into 3 different cryptocurrency mining companies in Canada. Namely DMG, DM, and HIVE. I am down 29.51% on these, but I have confidence. The main reason is just due to investing in Bitcoin mining stocks which I expect will do very well in this bull run and I am okay to risk this money as a bet on Bitcoin in the stock market. Though I will say, my journey with growth stocks has not been a very good one thus far.

For dividend stocks, I sold all of my food and grocery, sold some of my consumer goods, and sold out of my lower dividend-yielding stocks that I don’t see raising their dividend. I wanted to shrink my portfolio down more and focus on an average of 5% yield for my dividends. So I moved my funds into my stronger performing assets as well as two new ETFs, one for banking and one for banking & insurance. I mostly bought insurance and REITs to balance my portfolio out. I also upped my utilities a bit and bought some Cisco stock as they pay a modest 3.25% dividend. My portfolio in terms of sector breakdown is now 2% Technology, 4% Consumer Goods, 11% Utilities, 16% Insurance, 20% Banking, 21% Real Estate, and 26% into general ETFs. I want to get it balanced out to 2, 3, 10, 20, 20, 20, 25 respectively. My portfolio is very conservative for dividends, but it works well.

I am slowly selling off my cryptocurrency HIVE with about 400 being sold off in February and moved into ETH. I also bought $2,400 CAD worth of MTR for Den.Social which is already up over $200. This will help me earn passive income and curate content on the platform.

I am currently down 36.70% on my $5,000 worth of growth stocks and 9.17% on my $25,731 worth of dividend stocks including dividends with all income being reinvested and compounding interest.

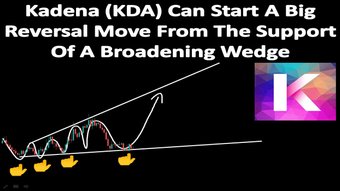

For crypto, I stocked up more on DASH and BCH. My breakdown is 8% LBC, 3% DASH, 2% BCH, 37% ETH, and 50% BTC. This is allegedly valued at $144,775 CAD at the time of writing this. I sold all my RealT tokens and began powering down Hive to go all in one on BTC & ETH as I truly believe the next 6 months will be life changing and I’m setting my financials accordingly.

For my templates on budgeting and investing and how to use them check out this video: https://odysee.com/@ScottCBusiness:4/If-You-Want-To-Save-Money:7

Was this helpful for you? What dividend stocks are you investing in? Do you prefer dividend investing or another style? Do you invest in cryptocurrencies that payout regularly? Let me know what you think about this in the comments below and don’t forget to subscribe!

This is a LBRY first video meaning it shows up on LBRY before it gets published anywhere else. If you’re not on LBRY, sign up and get started here: https://lbry.tv/$/invite/@ScottCBusiness:4

Check this video out on LBRY to support me with monetization and no ads: https://odysee.com/@ScottCBusiness:4/earn-free-crypto:4

Tags :

Their limit for today is $0!

Comments:

Reply:

To comment on this video please connect a HIVE account to your profile: Connect HIVE Account